PayPal money is on hold? Here in this post, we shall see why you PayPal money is on hold and what you can do about it.

PayPal is an online payment platform and is one of the largest online payment processors in the world. Using Paypal you can send money or make an online payment from anywhere. PayPal is a convenient platform for business owners to collect payment for their goods and services. If you are a freelance or provide some sort of services to make money from your website, then it is recommended to use PayPal to collect payment.

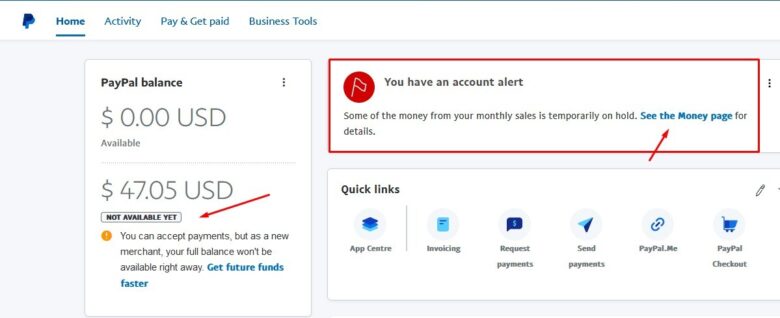

If your PayPal money is on hold in your PayPal account, it looks something like this:

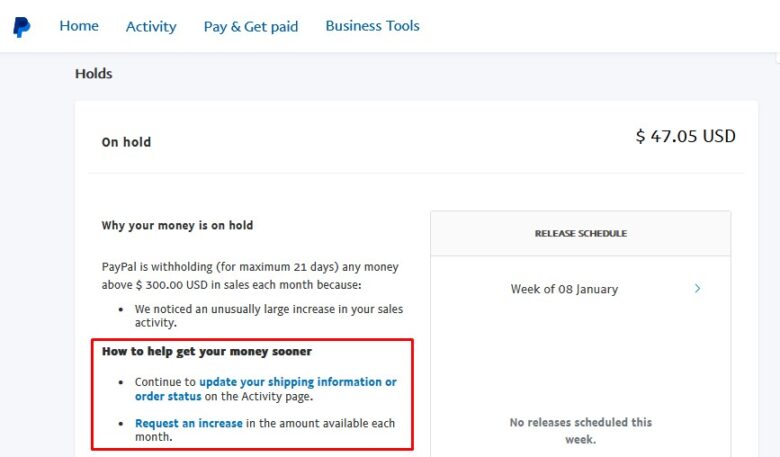

If you click on the “See the Money Page” link, you will see something like this:

Why your PayPal money is on hold? New to PayPal?

If you are new to PayPal, then it is normal. You must have already received an email from PayPal citing “Your funds are on hold – here’s what to do” informing you that your fund is on hold. The email may contain something like this-

Why we hold funds for new sellers.

Congrats on your recent sale. When you’re a new seller, we hold your received sales for up to 21 days so we can verify your identity and monitor your transactions. This is one way we help to keep PayPal safe for sellers and buyers.

If you see an email from PayPal with the above message, don’t worry, as PayPal hold fund for new sellers for up to 21 days. According to PayPal, this done to keep PayPal safe for sellers and buyers. As a new user, all you have to do is wait. But in the mean time, ensure that your bank acocunt and phone number are up to date.

Some reasons why your PayPal money is on hold:

- This is your first payment.

- Your PayPal account may have been inactive for a long time.

- The payment you received is different from your usual selling pattern.

- PayPal found an unusual change in selling price for a particular transaction.

- Suspicious activity.

- Customers filed complaints for a refund, dispute, or chargeback.

How to avoid PayPal holding your fund?

Here are some things you need to do so that PayPal can release your held up fund faster.

1. Print a shipping label via PayPal.

PayPal will track your package and release the fund on hold one day after the courier confirms delivery.

2. Add tracking.

Use one of the PayPal’s approved shipping carriers, and PayPal will release the fund on hold one day after the courier confirms delivery.

3. Update the order status for services or intangible items.

If you were paid for services, then obviously, there was no item shipped. So there is no question adding tracking or printing shipping label etc. As per PayPal, you can update the order status for intangible items, and PayPal will release funds in just seven days. If you look around, you might also have an email from PayPal with a message that reads:

If you provided a service or sold an intangible item that doesn’t require shipping (e-book, piano lessons, etc.): Mark the order as processed and provide details on the Transaction Details page. Your funds should be available within 7 days after you mark as processed (14 days if your buyer is based internationally).

Above all, if you are new to PayPal and this is your first payment which is held up by PayPal, then don’t worry. You just need to wait, for 21 days at least. Provided, your account details are up to date including bank account and phone number etc. Keep checking your emails, PayPal may send you some emails if there is anything that requires your attention.

#PayPal fund on hold – how to fix it

#why is my fund on hold on PayPal

# solution for paypal money on hold

# paypal money on hold not a seller

# how long paypal hold fund

# paypal 21 day hold

# paypal money received pending